Veelead employs automation technology in finance to perform tasks with little or no human intervention. This method allows for better utilization of knowledge workers, resulting in increased efficiency without the need to replace them. In essence, it involves automating repetitive manual tasks that are time-consuming. Our Finance Automation Service is designed to enhance process efficiency by decreasing or eliminating non-value-added repetitive procedures and activities. By automating these repetitive processes, finance automation can more precisely concentrate on generating value and driving strategy.

How Finance Automation Helps for Your Business

Finance automation helps your businesses in many ways. It increases efficiency, improves accuracy, accelerates processing time, ensures compliance, saves costs, facilitates informed decision-making, enhances reporting and visibility, offers scalability and adaptability, improves customer and vendor relationships, and frees time for strategic initiatives.

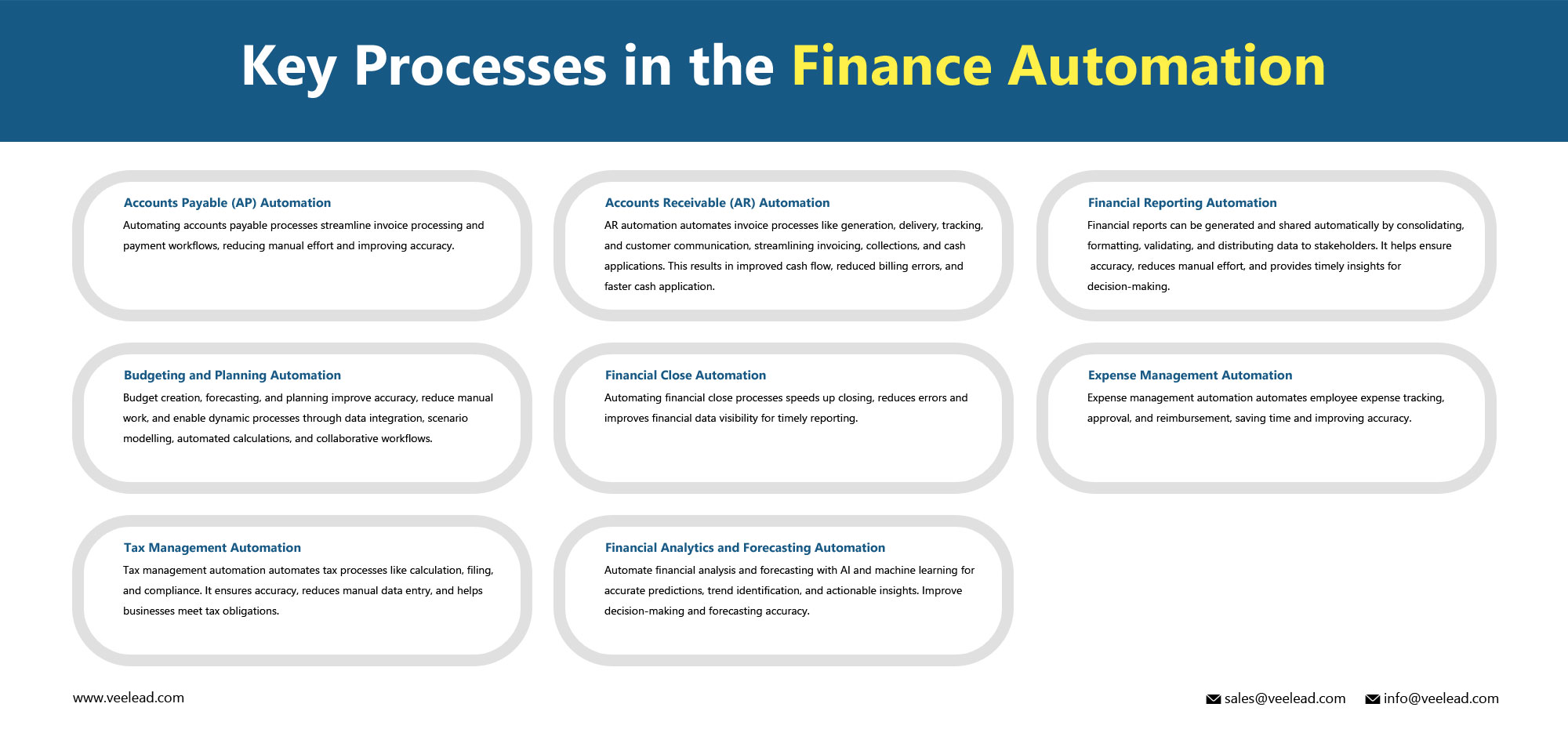

Key Processes in the Finance Automation

Finance automation involves automating various processes within the finance function. Some of the commonly automated processes include:

Automated processes may vary by organization, but they can improve finance functions significantly. Automation streamlines tasks, reduces errors, and enhances accuracy, leading to better decision-making.

How to Implement Financial Automation

Implementing financial automation involves several steps to ensure a successful implementation. Here is a helpful guide on how to implement financial automation:

Identify Processes for Automation: Automated financial processes comprise several tasks, such as processing invoices, managing payments, handling expenses, generating financial reports, and budgeting.

Set the Objectives: Clarify the goals and objectives of financial automation. Determine specific automation goals, such as reducing manual effort, improving accuracy, enhancing efficiency, or increasing compliance.

Assess Automation Tools: Research and evaluate automation tools and platforms for your organization. Consider functionality, ease of use, scalability, integration, and cost. Popular finance tools include RPA, workflow automation, and cloud-based automation.

Map Current Processes: Document and describe the existing financial processes in detail. Identify pain points, inefficiencies, and areas where automation can bring the most value. This will help you understand the workflow and determine where automation can be applied.

Design Automation Workflows:

- Design the automated workflows by breaking down the processes into individual steps and actions.

- Determine the triggers that initiate the automation, such as receiving an invoice or reaching a specific date.

- Define the workflow’s sequence of actions, data transformations, validations, and decision-making points.

Configure Automation Tools: Configure the selected tool to match your desired workflows. This may involve setting up connections to financial systems, defining data sources, configuring authentication, and designing automation logic using the tool’s features and capabilities.

Test and Validate:

- Test the automated workflows with sample data to ensure they function correctly.

- Validate that the automation produces the desired results, meets your objectives, and handles various scenarios effectively.

- Make adjustments and refinements as needed.

Implement in Phases:

- Implement financial automation in phases rather than trying to automate all processes simultaneously.

- Start with smaller, less complex processes to gain experience and build confidence.

- Gradually expand automation to more critical and complex processes over time.

Provide Training and Support:

- Train finance team on automated processes and tools.

- Ensure their understanding of workflows, troubleshooting, and benefits.

- Provide ongoing support.

Monitor and Optimize:

- Monitor the automated processes to ensure they run smoothly and deliver the desired results.

- Collect user feedback, analyze performance metrics, and make adjustments to optimize the automation workflows.

- “Always watch for chances to enhance efficiency, accuracy, and the user experience.”

Maintain Security and Compliance: Consider security and compliance requirements throughout the implementation process. Implement appropriate access controls, data encryption, and audit trails to protect sensitive financial information and comply with relevant regulations.

Evaluate and Expand: Regularly evaluate the impact of financial automation on your organization. Assess the achieved benefits, return on investment, and user satisfaction. Consider expanding automation to other finance processes or exploring integration with other business functions for end-to-end automation.

Conclusion:

Veelead’s financial automation service is gaining popularity and transforming how enterprises of all sizes process financial transactions. Although implementing new technology and procedures may seem daunting, there are several easy ways for businesses to streamline and optimize their financial processes.